What You Need to Know When Buying Property in Grindelwald

Make your real estate dream come true – we will support you every step of the way.

Our head start and in-depth knowledge of the local real estate market will help you realize your personal real estate dream. We carry out the necessary administrative work and accompany you on the way to your new home.

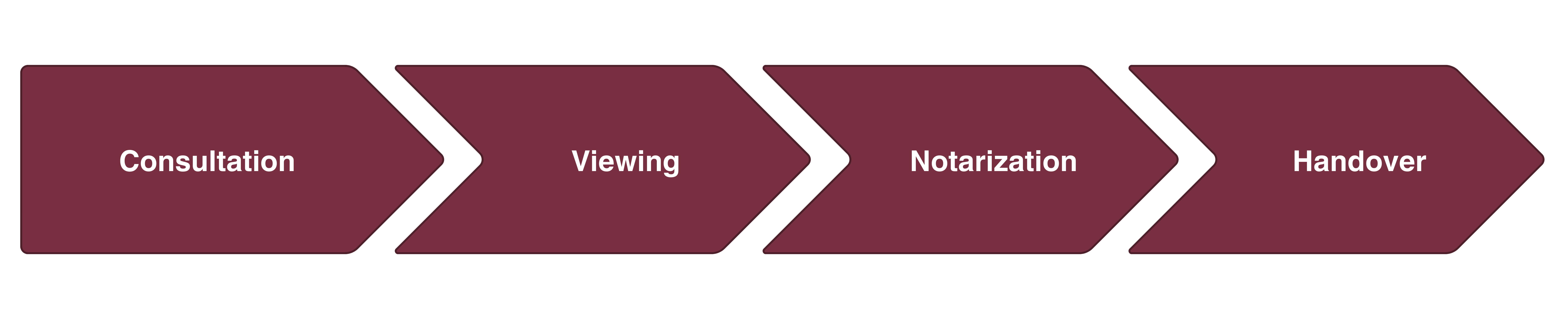

We support you in buying your dream house:

| CONSULTATION | Extensive clarification of requirements, tax and customs issues, settlement and location issues |

| VIEWING | Advice on possible conversion work by GRIWA ARCHITEKTUR AG, development and presentation of business concepts |

| NOTARIZATION | Preparation and organization of the notarization |

| HANDOVER | March-counted billing of electricity, water, property taxes, insurance, etc. Organization of the handover of the property including all necessary documents, relocation and moving |

Our dedicated team will accompany you step by step on the exciting path to buying a property

Our services begin with a comprehensive purchase consultation, during which we work together to define your requirements and wishes to find the perfect property for you. We will support you with our expertise during viewings and with further clarifications. Whether you have questions about relocation and location optimization, tax and customs aspects or legal and financial challenges – we are there for you.

With the GRIWA ARCHITEKTUR team, we also have the expertise you need when considering conversion or renovation options.

But our commitment does not end with your decision. We coordinate the notarization, take care of all necessary re-registrations with the authorities and insurance companies as well as the precise settlement of all costs relating to the property. At the end, we not only hand you your dream property, but also a carefully compiled list of keys and all the necessary documents. We make the journey to your new home just as exciting as the goal itself.

At GRIWA TREUHAND, it’s not just about buying real estate, it’s about creating living spaces and a flawless buying experience.

Get Informed Now and Purchase Your Dream Property Effortlessly

These five points will help you clarify your priorities and make an informed decision about purchasing your dream property in the Jungfrau Region.

- What is my budget for the purchase and ongoing costs such as taxes, additional costs and maintenance?

- What type of property do I want to buy? Do I prefer an apartment, a chalet or a detached house?

- What features of the property are important to me, such as the number of bedrooms and bathrooms, balconies and storage space?

- What are my priorities in terms of location, such as proximity to schools, stores, and public transportation?

- What leisure activities and other amenities do I want to take advantage of in the area, such as skiing, hiking, and swimming?

Once you have a clear understanding of your needs and desires regarding your dream property, you can contact a professional who can introduce you to available properties that meet your requirements.

In order to get a better impression of the property during a viewing and to obtain all the important information, you will find a questionnaire here, which will help you to ask the right kind of questions.

If you decide to buy a a, it is important that you are well informed about the different aspects of a mortgage. Through this guide, we will explain the 5 most important points you should consider when applying for a mortgage, as well as useful tips and tricks that can help you complete a successful application.

- Choose a bank that has extensive knowledge of the regional real estate market to ensure you get valuable insight into local market trends and pricing, as well as the best possible assistance in choosing the right mortgage loan.

- Credit Score: Banks check a person’s credit score before approving a mortgage. Make sure you have sufficient collateral and a positive credit history.

- Proof of income: Banks require proof of monthly income and other assets. Make sure you have all the necessary documents ready.

- Type of mortgage: Learn about the different types of mortgages and decide which one fits your needs best.

- Interest rates and fees: Compare offers from different banks in the area regarding terms and conditions to find the best deal

When purchasing a property in the Jungfrau Region, the following ancillary acquisition costs may be incurred:

- Notary and land registry costs: These costs are necessary for the legal processing of the purchase and to complete the record in the land registry. They amount to about 1% of the purchase price.

- The transfer of ownership tax is a tax that applies to the purchase of real estate in Switzerland. This tax is a sales tax levied by the cantons. The amount of the tax in the canton of Bern is approximately 1.8% of the purchase price.

- Insurance costs: It is advisable to take out building liability and household insurance to protect your investment. Building insurance is mandatory in the Canton of Bern.

- Financing costs: If you take out a loan, interest and fees will be incurred.

These costs can vary depending on the canton and your specific situation. It is important to find out the exact costs before you decide to buy and to include them in your budget planning.

There are many legal aspects that must be considered when purchasing real estate. These include aspects such as verifying ownership status and land registry, verifying building and use restrictions, reviewing building code issues, and preparing a formal purchase agreement in writing. It is important that buyer:s thoroughly understand and follow these aspects to ensure a smooth and successful real estate purchase.

In additionato the general legal aspects of buying real estate, Switzerland also has special regulations for the purchase of second residences, which are set forth in the Second Residence Law. This law limits the number of second residences allowed per municipality and specifies the conditions under which they may be purchased. It also regulates the conditions for renting second homes to tourists and the taxation of such units. It is important that buyers ensure that they comply with the requirements of the Second Residence Law to ensure a successful and lawful purchase.

Handing over the property is an essential process that ensures that both buyer and seller know their respective responsibilities and rights. Here are some of the most important issues to consider when handing over a property:

- Condition as seen: Generally, the principle of “condition as seen” applies to the transfer of a property. This means that the property is handed over in the condition it was in at the time of purchase, unless otherwise agreed.

- Difference new construction to older properties: The handover process can be different for new construction and older properties. New construction is often not fully constructed, while older properties may need repairs or renovations.

- Key inventory: It is important to have a complete key list at the time of transfer to ensure that the buyer has access to all parts of the property.

- Mutations: The handover of a property must also include the transfer of ownership to the buyer, which is usually done through a mutation in the land registry. In addition, the change of ownership must also be reported to the municipal and tourist authorities, the electricity provider, the insurance companies and, if applicable, to the property management company.

Overall, when buying a property in the Grindelwald area, it is very important to carefully consider the various aspects and steps involved. Thorough preparation in these areas can help to ensure that the transaction runs smoothly and stress-free and that you are satisfied with your new property in the end.